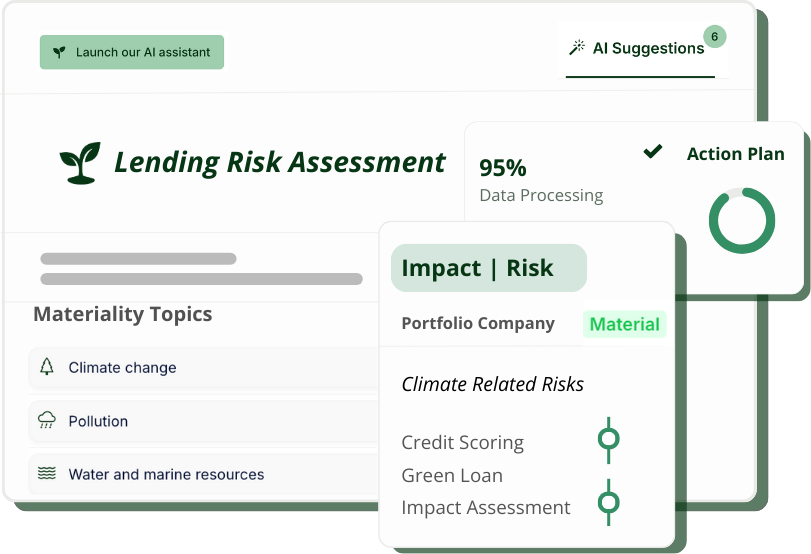

Assess Credit Risk

for SME's

Instantly understand borrower sustainability risks and opportunities, ensuring informed and secure credit assessments.

How it works

Enter Company Details

Add borrower data for instant sustainability risk evaluation.

AI Analysis

FINGREEN AI's double-materiality approach identifies hidden climate risk exposures.

Receive Results

Receive actionable insights for accurate credit pricing and climate risk mitigation strategies.

Benefits to you:

-

Strengthened Lending Decisions

Enhance borrowing risk assessments with clear, actionable data. -

Alignment to Basel Capital Frameworks

Align with EBA Guidelines, CRR/CRD Updates, ECB Supervision. -

Reduced Climate-Related Exposure

Minimize potential financial losses with proactive risk identification. -

Proactive Risk Mitigation

Spot sustainability risks before they impact lending quality. -

Simplified ESG Due Diligence

Streamline your due diligence process for stronger lending decisions based on uncovered sustainability risks.

See FINGREEN AI in action and discover how it can transform your risk management approach. 🌱

See FINGREEN AI in action and discover how it can transform your risk management approach. 🌱

Speak with our experts to discuss your specific needs.

Why use our tool?

Save Time and Money

Get fast, expert-level risk assessments.

Make Better Decisions

Identify and address risks early for stronger, more sustainable growth.

Meet Stakeholder Requirements

Streamline due diligence, finance reviews.

Stay Compliant

Easily meet changing ESG regulations.