Banks |

Venture Debt Funds |

Private Debt Fund

Private Creditors

You need...

Our solution...

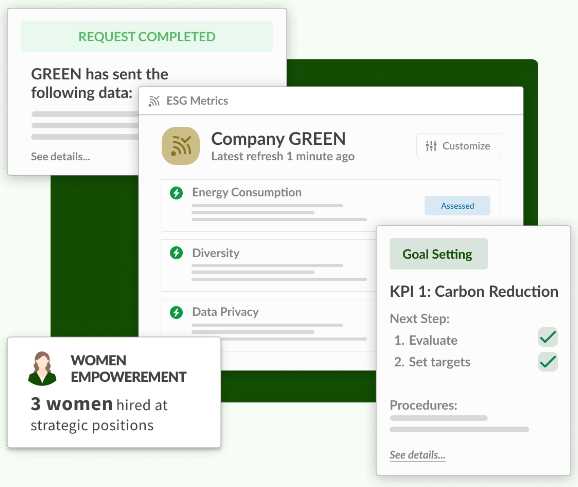

to relate credit rates with ESG performance and sustainable KPIs

easily assesses and monitors non-financial performance

better data collection systems from non-responsive portfolio companies

streamlines data collection processes with visualized dashboards

clear ESG frameworks without disparate types of black-box methodologies

uses transparent processes by digitizing existing international frameworks

Private debt investors face significant challenges when using ESG as a metric for investment decisions

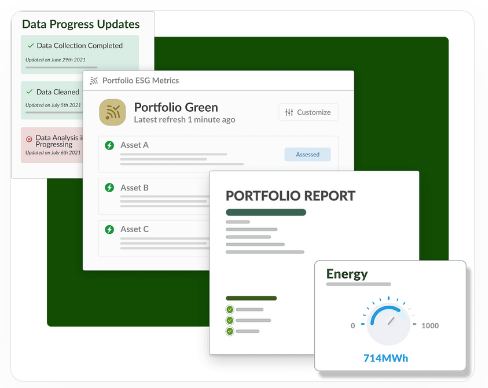

We’ve created a simple and comprehensive tool to make ESG-related diligence a seamless process for private debt providers

75 %

Manual Tasks Automated

500+

ESG Metrics Covered

6 x

Faster Reporting Process

Benefits

ESG risk assessments and projections which can be personalized based on specific portfolio strategy

Centralized data collection to monitor vast data-sets across multiple portfolios.

Streamline processes, reduce costs and improve efficiency

Discover how our ESG solutions can fit your exact needs & experience our platform first-hand!